The Ultimate Beginner’s Guide to Investing in Index Funds

If you’re seeking a simple, cost-effective, and long-term strategy to grow your wealth, index funds may be the perfect investment option for you. Over the past few decades, index funds have become a staple in the portfolios of both individual investors and large institutional players. By tracking the performance of a specific market index, these funds offer an easy way to gain exposure to a wide range of stocks without the complexity or high fees associated with actively managed funds.

As David Tenerelli, a certified financial planner, aptly states:

“The biggest hurdle to profitable investing is management fees. With a passive, index-based approach, investors can keep fees low and diversify across various sectors, industries, and regions. This allows you to benefit from overall economic growth, regardless of how individual companies perform.”

Let’s dive deeper into what index funds are, how they operate, and why they could be a wise addition to your investment portfolio.

Key Takeaways:

- Low-Cost, Passive Investment: Index funds track the performance of a specific market index, providing a cost-efficient, passive investment strategy.

- Lower Fees & Taxes: Compared to actively managed funds, index funds typically have lower management fees and tax liabilities.

- Diversification: They offer broad diversification, helping to spread risk across different sectors, industries, and regions.

- Long-Term Strategy: While they offer solid returns, index funds are not ideal for investors looking for quick gains or short-term flexibility.

What Is an Index Fund?

An index fund is a type of investment fund—either a mutual fund or exchange-traded fund (ETF)—designed to track the performance of a specific market index. Common examples of these indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq-100. Unlike actively managed funds, where a fund manager actively selects which securities to buy and sell, index funds use a passive investment approach, attempting to mirror the index’s performance by investing in the same assets in the same proportions.

For instance, when you invest in an S&P 500 index fund, you’re essentially buying small slices of all 500 companies included in the index. This gives you broad exposure to large-cap U.S. companies without having to pick individual stocks. In one simple transaction, you’re investing in multiple industries, from technology to healthcare, consumer goods to finance.

How Index Funds Work:

- Passive Strategy: Instead of relying on a fund manager’s expertise to select stocks, index funds simply track the composition of their respective indices. This passive approach means lower management fees, as there’s no need for expensive active research or frequent trading.

- Tracking the Index: The goal of an index fund is not to outperform the market, but to replicate the market’s performance as closely as possible. This is why they are often referred to as “passive funds”.

By investing in an index fund, you are effectively spreading your money across a diversified portfolio of assets within that index, thus reducing the risk associated with investing in individual stocks.

The History and Popularity of Index Funds

The concept of index investing was first introduced in the 1970s by John Bogle, the founder of Vanguard Group. Bogle’s idea was simple: rather than trying to outperform the market through stock picking or active management, investors could simply track the market and earn returns that matched overall economic growth. Although the idea was initially met with skepticism, index funds have grown exponentially in popularity over the years.

As of today, index funds manage over $16 trillion in assets, making them one of the most popular investment vehicles in the world. Both individual investors and institutional investors—such as pension funds, endowments, and sovereign wealth funds—utilize index funds to gain low-cost exposure to the broader markets.

The growing popularity of index funds is also evident in the ETF market, which has surged in recent years as investors look for more flexibility and lower costs. Today, ETFs that track major indices like the S&P 500, Nasdaq-100, and Russell 2000 are traded globally, providing both retail and institutional investors with an easy way to access diversified, low-cost investment options.

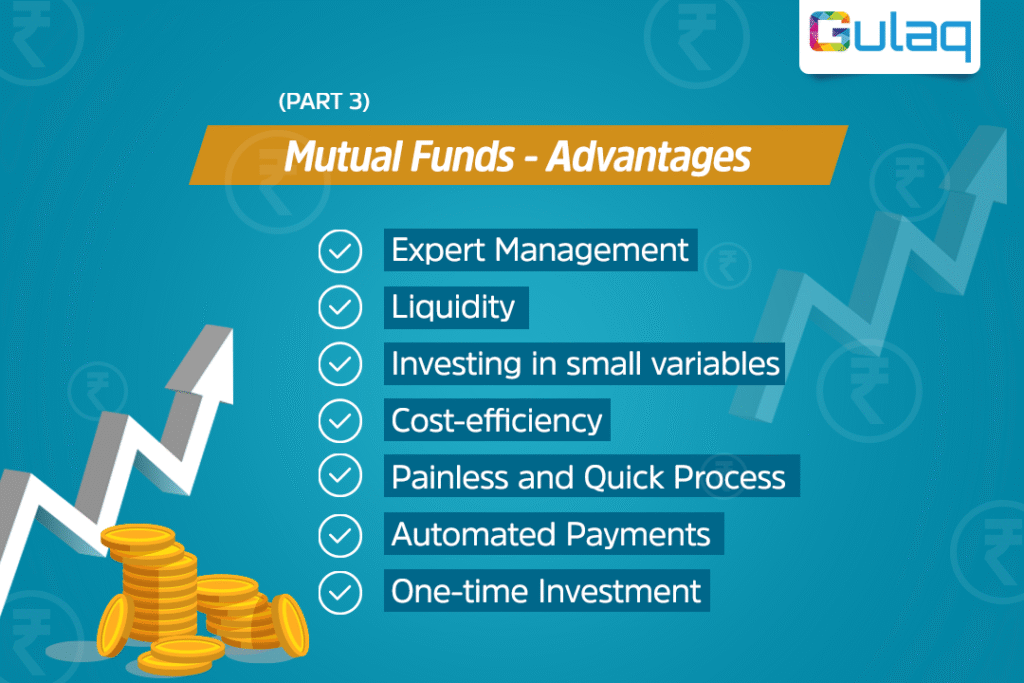

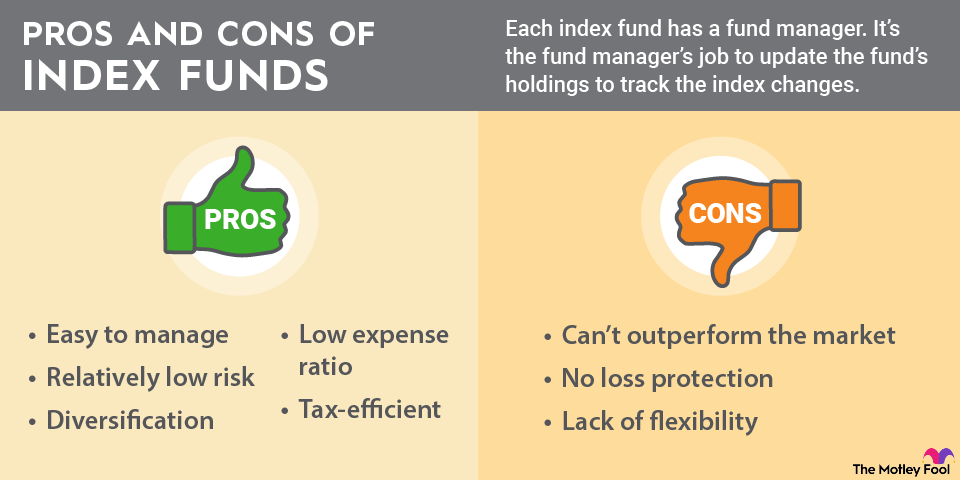

Advantages of Investing in Index Funds

1. Cost Efficiency

One of the biggest advantages of index funds is their low-cost structure. Unlike actively managed funds, which charge high management fees due to frequent trading and research costs, index funds have minimal operating costs. As a result, expense ratios—the fees charged by the fund for managing your money—are typically much lower. For example, while actively managed funds might have expense ratios as high as 1-2%, index funds often charge expense ratios of 0.03% to 0.10%.

2. Diversification

By investing in an index fund, you gain instant diversification. A single fund can provide exposure to hundreds or even thousands of different stocks, depending on the index it tracks. For example:

- The S&P 500 includes 500 of the largest publicly traded companies in the U.S., spanning multiple industries.

- The Total Stock Market Index includes a broader range of U.S. stocks, covering large-, mid-, and small-cap stocks.

This broad diversification helps spread out the risk and reduces the impact of poor performance from any one individual stock.

3. Steady Long-Term Growth

Index funds are designed for long-term investors. The goal is not to make quick profits, but rather to benefit from overall market growth. Over the long run, markets tend to rise, despite short-term volatility. Historically, broad market indices like the S&P 500 have provided average annual returns of about 7% to 10%, depending on the time frame.

4. Simplicity and Transparency

Index funds are easy to understand and transparent. Unlike actively managed funds, where you rely on the judgment of the fund manager, index funds simply track an index’s performance. This means you always know what assets you hold in the fund and can easily track its performance relative to the market index.

5. Lower Taxes

Due to the passive nature of index funds and their low turnover, they typically generate fewer taxable events compared to actively managed funds. This means capital gains taxes on your earnings may be lower, which can be especially beneficial for investors in higher tax brackets.

When Index Funds May Not Be Ideal

While index funds are an excellent choice for many investors, they may not be the best option in every situation:

- Seeking Quick Gains: Index funds are designed for long-term growth, not short-term profits. If you’re looking for fast gains or a more active approach to investing, index funds may not provide the level of flexibility or short-term potential you desire.

- Desire for Flexibility: Index funds automatically track a market index, meaning they don’t allow for active stock picking. If you’re looking to customize your portfolio by selecting individual stocks or sectors, index funds may be too passive for your strategy.

- Narrow Market Focus: Some investors might prefer funds that focus on specific sectors or niches (e.g., technology, healthcare, or emerging markets) rather than the broad market exposure provided by index funds.

Conclusion: A Smart Addition to Your Portfolio

Index funds are one of the best options for long-term investors seeking a simple, cost-effective, and diversified way to grow wealth. Their low fees, broad diversification, and reliable performance make them a key component of many successful investment strategies.

While they may not be ideal for those looking for quick gains or highly customized portfolios, index funds provide a great solution for investors focused on steady, long-term growth. Whether you’re just starting your investment journey or building a portfolio for retirement, index funds offer a reliable and easy-to-understand path toward financial security.

By incorporating index funds into your investment strategy, you can take advantage of the broader economic growth while keeping your costs low and reducing risk through diversification.