Debentures vs. Bonds: Key Differences and Insights

Understanding the distinction between debentures and bonds is crucial for anyone navigating the world of fixed-income investments. While both are debt instruments that allow companies and governments to raise capital, there are key differences that can affect the risk profile, returns, and investor appeal. Simply put, all debentures are bonds, but not all bonds qualify as debentures. The primary difference lies in whether the debt is secured by assets.

In the U.S., a bond that isn’t backed by collateral is referred to as a debenture. In contrast, in the UK, a debenture typically refers to a bond that is secured by the issuing company’s assets. This distinction can vary depending on the country, so it’s important to understand the local context when discussing these instruments.

Key Takeaways:

- Debenture: An unsecured bond, primarily issued based on the creditworthiness of the issuer (in the U.S. terminology).

- Bonds: Broader category of debt instruments that may or may not be secured by physical assets.

- Treasury Bills and Treasury Bonds: In the U.S., these are considered debentures since they are unsecured.

- Risk and Return: Debentures typically carry a higher risk than secured bonds, as they are not backed by collateral.

What Are Debentures?

A debenture is a form of unsecured debt issued by corporations or governments, meaning it is not backed by physical assets. Instead, debentures depend on the issuer’s creditworthiness and its ability to generate future profits or revenue. Since there is no collateral to fall back on in case of default, debentures are generally viewed as riskier compared to secured bonds.

Features of Debentures:

- Unsecured Debt: No specific assets or collateral are pledged as security for repayment. The bondholders must rely on the issuer’s credit and financial health.

- Issuer: Commonly issued by corporations and sometimes by governments, debentures are a popular way to raise capital for specific projects, expansion, or general corporate funding.

- Interest Rate: Debentures may offer a fixed or floating interest rate, depending on the terms set by the issuer. Investors are compensated with regular interest payments.

- Repayment Schedule: The principal may be repaid in one lump sum at maturity or in periodic installments (a feature known as the debenture redemption reserve).

- Convertible Options: Some debentures are convertible, allowing the bondholder the option to convert the debt into the issuing company’s stock. This feature is often appealing to investors who seek potential capital appreciation if the company’s stock price increases. Non-convertible debentures do not offer this conversion option, and they are typically offered at higher interest rates to attract investors.

- Subordinated vs. Senior Debentures: Debentures can be subordinated or senior. Senior debentures take priority in the event of liquidation, while subordinated debentures are paid only after senior debt holders have been paid.

Because debentures are unsecured, they tend to have higher interest rates than secured bonds to compensate investors for the additional risk. However, they are also riskier, particularly if the issuing company faces financial difficulties.

What Are Bonds?

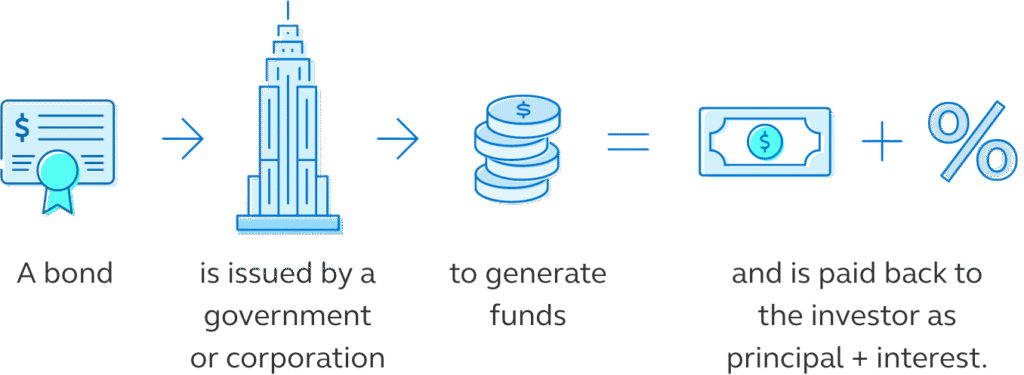

Bonds are one of the most widely used debt instruments in both corporate and government financing. When an entity issues a bond, it is essentially borrowing money from investors in exchange for periodic interest payments and a promise to return the principal at maturity.

Unlike debentures, bonds can be either secured or unsecured, depending on the terms of the bond issuance. Secured bonds are backed by specific assets, which act as collateral, providing bondholders with a form of protection in case of default. If the issuer defaults, bondholders can claim the assets pledged as security.

Features of Bonds:

- Secured vs. Unsecured: Bonds can be secured by physical assets, such as real estate, equipment, or other tangible collateral. These are known as secured bonds, while bonds that are not backed by collateral are unsecured (similar to debentures).

- Issuer: Bonds can be issued by governments, municipalities, or corporations. Government bonds, such as U.S. Treasury Bonds, are considered one of the safest investments because they are backed by the full faith and credit of the government.

- Interest Payments: Bondholders receive regular coupon payments, which are typically fixed or variable depending on the bond’s terms. These interest payments are typically made semi-annually or annually.

- Principal Repayment: At maturity, the principal amount (also called the face value) of the bond is repaid to the bondholder.

- Risk Profile: Bonds with a high credit rating (like AAA rated government bonds) are considered safer investments, as they are less likely to default. Bonds from corporations with lower ratings (junk bonds) come with higher risk but also higher potential returns.

The risk associated with bonds largely depends on the creditworthiness of the issuer and the type of bond issued. Government bonds generally carry lower risk compared to corporate bonds, particularly for bonds issued by highly rated governments like the U.S. Treasury.

Comparing Debentures and Bonds

| Feature | Debenture | Bond |

|---|---|---|

| Secured vs. Unsecured | Unsecured (in U.S.) | Can be secured or unsecured |

| Risk | Higher due to lack of collateral | Lower for secured bonds (backed by assets) |

| Issuer | Corporations, Governments | Corporations, Governments, Municipalities |

| Interest Rates | Typically higher due to higher risk | Varies depending on the type (secured or unsecured) |

| Repayment | Fixed or floating interest; lump sum or periodic installments | Fixed or floating interest; principal repaid at maturity |

| Examples | U.S. Treasury Bonds (in U.S.) | Corporate Bonds, U.S. Treasury Bonds, Municipal Bonds |

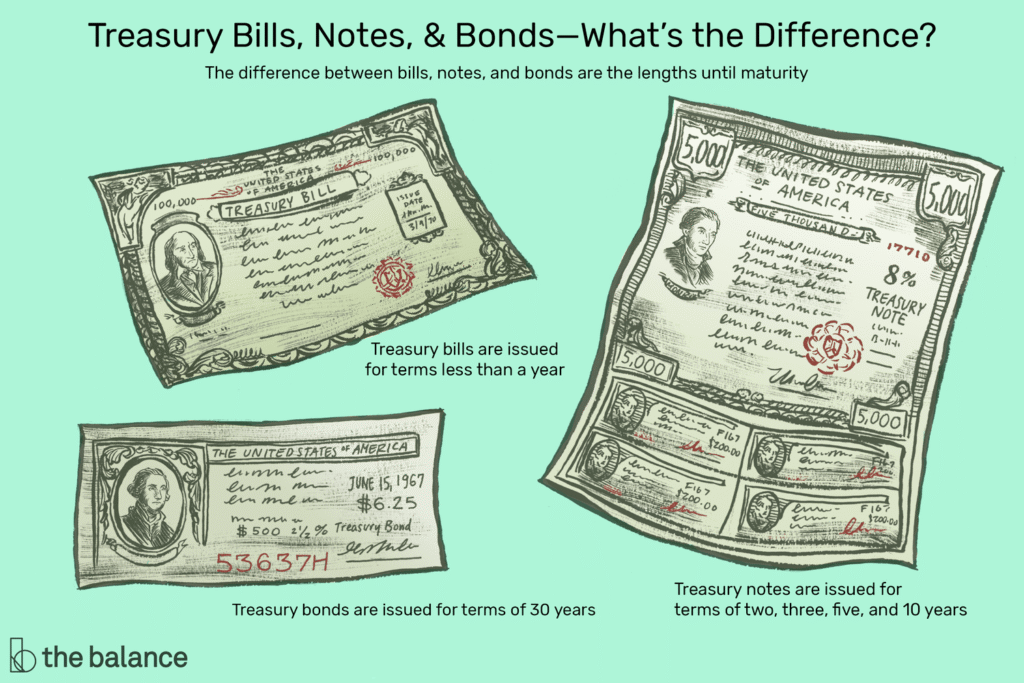

Treasury Bills and Bonds: A Special Case

In the United States, Treasury bills and Treasury bonds are classified as debentures because they are not backed by any physical collateral but are instead backed by the full faith and credit of the U.S. government. While these are technically debentures, they are considered among the safest investments due to the U.S. government’s financial stability. The interest rate on these debentures tends to be lower compared to corporate bonds because of the low risk involved.

Conclusion: Understanding the Distinction

The key difference between debentures and bonds boils down to whether or not they are secured by physical assets. While debentures are unsecured (in the U.S. context), meaning they are based on the issuer’s creditworthiness, bonds can be either secured or unsecured, depending on the terms of the bond issuance.

Investors must assess the level of risk, the issuer’s creditworthiness, and the terms of the debt before investing in either debentures or bonds. Secured bonds offer more protection due to the underlying collateral, while debentures offer higher potential returns but at a higher risk.

Understanding these differences is essential when building a diversified portfolio of fixed-income securities, as each type offers unique risks and rewards that cater to different investor preferences and financial goals.